Warrior Trading: Your Guide to Its Trading Styles – Day-trading has become an increasingly popular goal for individuals seeking economic freedom and independence. Trading the areas offers the offer of high returns, but it also includes lots of risk. The beauty of day-trading—in theory—is that by working the areas, a person can construct their wealth by trading only several hours a day. But to create it as an effective time trader means understanding the areas, how they shift, and how you can take advantage of those movements. That’s why it’s crucial to appreciate the various kinds of trading strategies employed by time traders and to locate those that perform most useful for you. To assist you do this, Warrior Trading has assembled a fast guide to trading styles. Here it is.

Table of Contents

What type of trading does Warrior Trading focus on?

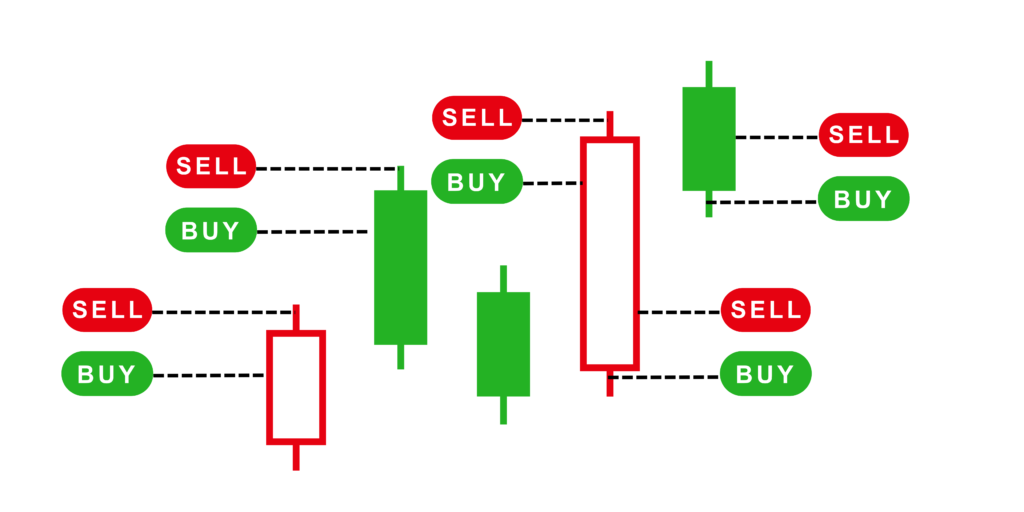

Warrior Trading is targeted on the trading models which can be typically employed by time traders. Unlike getting an inventory to keep in your profile as an investment for years, day-trading is all about obtaining short-term options in the market—frequently for five minutes or even a few hours. The item of day-trading is to recognize an inventory that’s moving upward, then take advantage of those activities and make a profit by getting minimal and offering high. Warrior Trading shows a variety of trading models for time traders, concentrating on methods which can be scalable—strategies which can be learned and utilized with a tiny trading account and then adapted as your account develops larger with raising trading success.

How does Warrior Trading explain momentum trading?

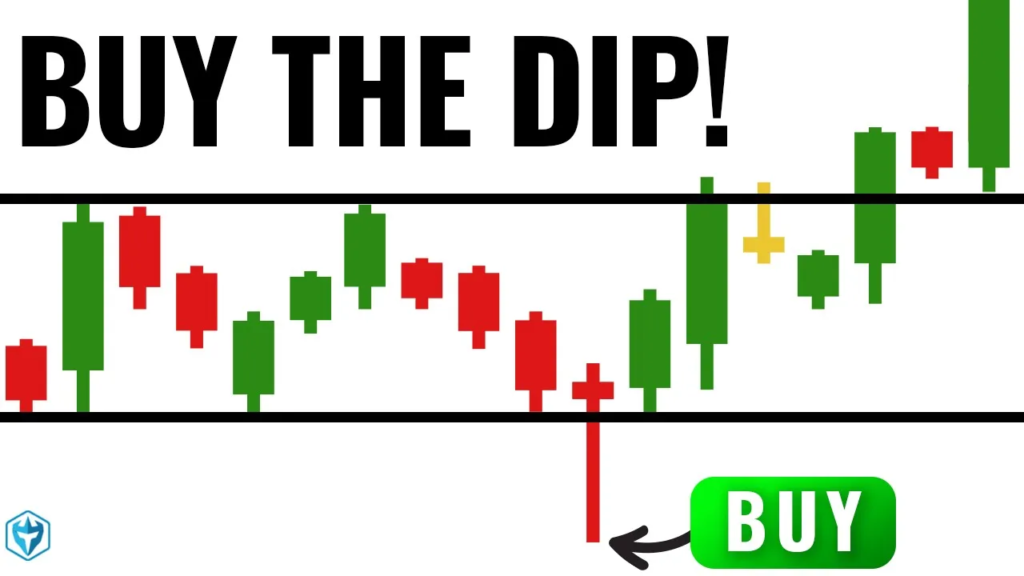

Traction trading is the most typically used—and a lot of Player Trading’s specialists would say effective—methods to day-trade. Like almost every other form of trading strategy (except for brief offering, which we won’t get into here), momentum trading requires determining an inventory whose price is on an upward trajectory—getting minimal and offering high. Particularly, momentum trading is getting and offering shares on the basis of the stock’s recent energy of price trends (like the reaction to positive or bad news). In the span of nearly every single industry trading time, it is possible that an inventory may shift 20% to 30%. A great momentum trading fashion may recognize price movements with enough power to their rear to carry on upward activities for a constant amount of time. If they find one of these treasures, the momentum trader pounces and tours the wave till prior to they think it’s likely to subside.

How does the platform explain scalp trading?

Traction trading and scalping are extremely similar and are often puzzled because, theoretically, there’s really just a small difference—in principle—between them. But as far as Warrior Trading is worried, in practice—and in execution—there’s a large disparity. Equally involve the trader to recognize a protection that, over a short time figure, is moving up in price. The useful huge difference is that scalpers want to bank very quick increases from an upward-moving inventory, while momentum traders aim to bank the utmost possible gain possible from the inventory in one day. The upshot is that crown traders are generally more traditional in their price targets. Scalp traders only need a tiny slice of the upward-moving activity and may attempt to recognize numerous quick trades a day (maybe lasting as low as a couple of seconds or minutes). Traction traders, on the other hand, are seeking to capture the biggest increases possible in a regular price move. And that could suggest holding the inventory for half an hour up to a couple hours.

How does it explain swing trading?

While momentum and crown trading are correct day-trading models since the activity and execution take position all in the span of 1 day (and perhaps in just moments, moments, or hours), swing trading is a little different, Warrior Trading explains. Swing trading is however a trading fashion used frequently by persons looking to apply short-term trading strategies, therefore it’s excellent to understand how it works.

A swing industry is each time a trader tries to bank make money from an inventory shift that can occur immediately or several months down the road.

Traders performing swing trades search for shares with the potential to improve in price consequently of some identifiable event, like a positive earnings release from the business, the story of a encouraging new product, or even a geopolitical event that might gain their business (like the end of a war, the story of new government rules, or the starting of a new market).

As an example, if the Food and Medicine Administration is approximately to approve a new form of medicine reviewed by way of a pharmaceutical organization, that company’s inventory might be set to rise—maybe dramatically.

To discover a successful swing industry prospect, traders have to sniff out the news headlines or recognize a tendency likely to maneuver inventory or sector.

How does Warrior Trading explain position trading?

Position trading is typically known as “buy-and-hold.” As a result, it isn’t a really day-trading strategy, but it’s worth understanding what it is and how it operates because the fundamental process can be used in a day-trading environment. Position trading is determining an inventory to keep over an even more expanded period of time (a couple of days at the minimal, around even a few months or years). When the inventory has been determined, position traders set their position objectives (like hitting a particular price for a experienced period). When the target has been achieved, position traders close their investments.

While momentum traders and scalpers search for short-term price activity, position traders aren’t really focused on short-term price action or daily increases or losses. They’re more like investors—holding for a lengthy time period and then offering to take advantage of long-term, frequently substantial fluctuations in the inventory price. It requires committing money for the long term.

Traction trading, scalping, swing trading, or position trading— Warrior Trading proposes understanding all the models at a trader’s removal and formulating a strategy that operates for you.

Disclosure: Financed content. Sponsorship may include, but isn’t limited by: cost for position to the book, to the author for their time, and other arrangements.